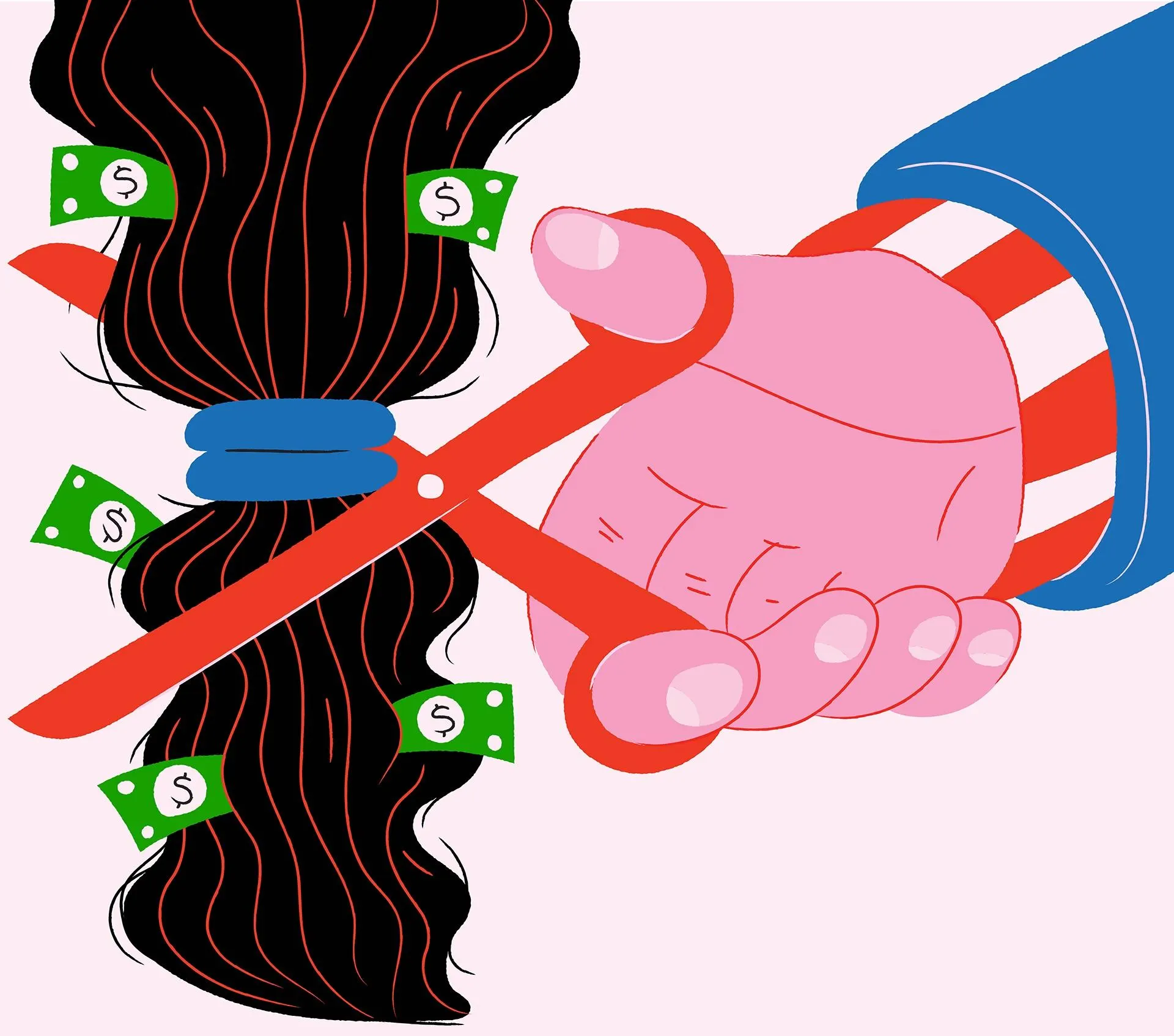

Congress created a big incentive for restaurants and bars to report employees’ tips, which can be good for workers, too—even if many don’t believe it. So why hasn’t it done the same for the largely female-owned beauty industry?

The holidays are coming and Paige Garland, co-owner of Rachel’s Salon and Day Spa in downtown Memphis, is bracing for a tax hit. Along with springing for more of the salon’s $72 event up-dos and $94 highlights, customers will also be giving more-generous-than-usual tips to their favorite stylists. As a matter of salon policy, those holiday tips will be rung up separately on Rachel’s payment processing system with 100% going to the employee and all of it properly reported as income to the Internal Revenue Service on the stylists’ W-2 forms.